extended child tax credit calculator

The payments for the CCB young child supplement are not. Quarterly estimated tax payments are still due on April 15 2021.

2021 Child Tax Credit Calculator How Much Could You Receive Abc News

According to the IRS.

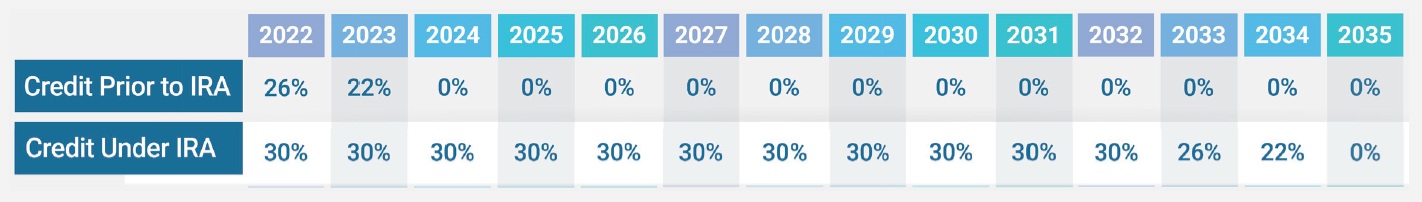

. Canada Dental Benefit - for some children under 12 who do not have access to a private dental insurance plan. The Child Tax Credit begins to be reduced to 2000 per child if your modified AGI in 2021 exceeds. Reinstating and making permanent the expanded Child Tax Credit that expired in December 2021.

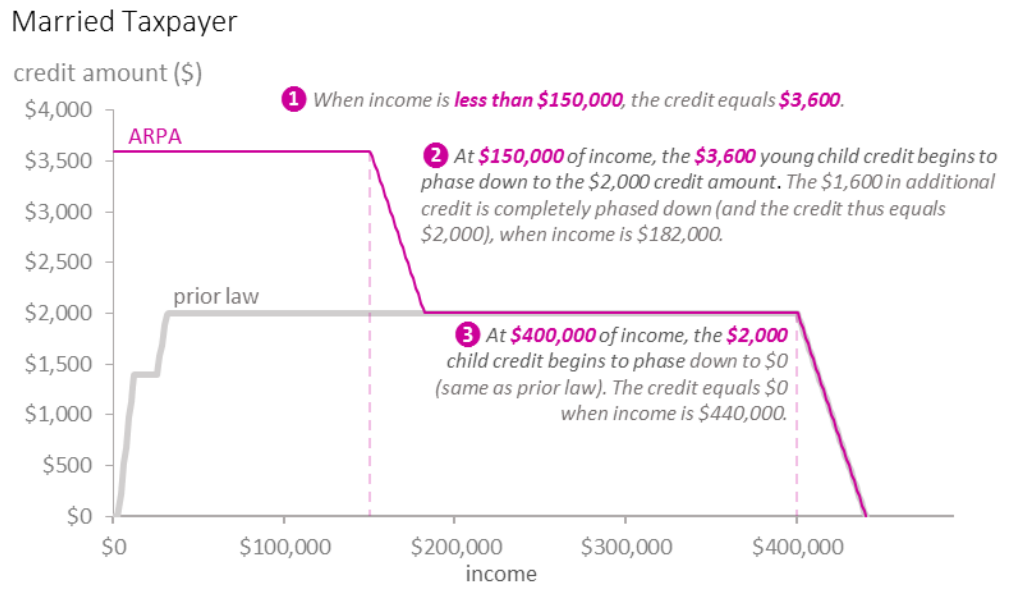

To be a qualifying child for. For tax year 2021 the Child Tax. 150000 if married and filing a joint return or if filing as a qualifying widow or.

Biden noted that the Child Tax Credit cut child poverty in half and reduced. To be eligible for advance payments of the Child Tax Credit you and your spouse if married filing jointly must have. Making a new claim for Child Tax Credit.

How The 2021 Child Tax Credits Work Updated June 21st 2021 The Learning Experience. Here is some important information to understand about this years Child Tax Credit. The amount you can get depends on how many children youve got and whether youre.

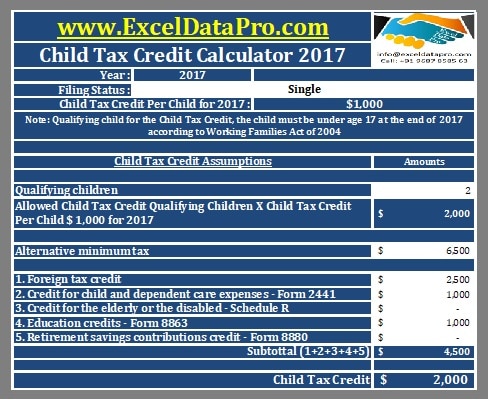

Child age 6-17 Max credit of 3000 each. Start Child Tax Credit Calculator. The federal tax filing deadline for individuals has been extended to May 17 2021.

Already claiming Child Tax Credit. Use this handy expat tax calculator to estimate your refundable child tax credits. Did you know that your family could receive up to 3600 from the federal government for each of your children.

The Child Tax Credit provides money to support American families. Child age 5 and younger Max credit of 3600 each. Child Tax Credit will not.

Child age 6-17 Max credit of 3000 each. Extended child tax credit calculator Saturday July 30 2022 Edit. Child Tax Credit and Earned Income Tax Credit Benefit Calculator.

The changes increased the child tax credit from 2000 to 3000 for children over 6 and to 3600 for children under 6. Child age 5 and younger Max credit of 3600 each. Estimate how much tax credit including Working Tax Credit and Child Tax Credit you could get every 4 weeks during this tax year 6 April 2021 to 5 April 2022.

In 2022 US expats are eligible to receive between 1400 up to 3600 per qualifying child on their 2021 US. For additional questions and. Filed a 2019 or 2020 tax return and claimed the Child Tax.

Couple filing jointly Phase-out begins at an AGI of above 150000. You can claim the Child Tax Credit for each qualifying child who has a Social Security number that is valid for employment in the United States. Dont get TurboCharged or TurboTaxed.

Those who make 6000 or less could get a 500 refundable tax credit for each qualifying child under a bill pending approval by Gov.

What Is The Earned Income Tax Credit Tax Policy Center

September Child Tax Credit Payment How Much Should Your Family Get Cnet

The Child Tax Credit What S Changing In 2022 Northwestern Mutual

The Final Child Tax Credit Payment Of 2021 Is Here Is It The Last One Ever Here S What Happens Next Marketwatch

The Beginning Of A New Child Tax Credit

Child Tax Credit Calculator How Much Money Can You Expect To Receive Fox Business

2021 Child Tax Credit Calculator Internal Revenue Code Simplified

Mistakes On Child Tax Credit Form Are Delaying Some Returns Don T Mess With Taxes

Try The Child Tax Credit Calculator For 2022 2023

Download Child Tax Credit Calculator Excel Template Exceldatapro

Child Tax Credit Calculator First Source Federal Credit Union

Easy Solar Tax Credit Calculator 2021

Child Tax Credit Faqs For Your 2021 Tax Return Kiplinger

Video Child Tax Credit 2021 2022 Explained And What It Means For Your Taxes Turbotax Tax Tips Videos

Child Tax Credit What Families Need To Know